Currency Risk - what is it anyway?

March 10 - written by Kamil Kołodziejczyk

In today's global world, where companies increasingly do business with foreign partners, currency risk has become an integral part of doing business. Did you know that even small fluctuations in currency rates can have a huge impact on your P&L? In this article, I will try to explain what currency risk is and why it is so important for your company.

What is currency risk?

Currency risk is the possibility of financial losses due to unfavourable changes in currency rates. It concerns companies that make transactions in foreign currencies, both exporters and importers. Currency fluctuations are inevitable and depend on many factors, including the economic and political situation, or market speculation.

What determines exchange rates?

Exchange rates are dynamic and subject to constant change. They are influenced by both economic and political factors. The most important of these include:

- Demand and Supply: If there is a lot of demand for a currency, its exchange rate rises and conversely, when there is a lot of supply of a currency, its exchange rate falls.

- Interest rates: High interest rates in a country attract investors, which increases demand for that country's currency and raises its exchange rate.

- Inflation: High inflation in a country can lead to a decline in the value of its currency.

- Economic situation: A strong economy of a country usually attracts investors, which translates into an increase in its currency's exchange rate.

- Political situation: Political uncertainty in a country can lead to a decline in the value of its currency.

- Speculation: Currency speculators can influence currency rates by buying or selling large amounts of a particular currency.

Understanding these factors is crucial for individuals and businesses that trade in different currencies. It allows them to better manage their currency risk and make more informed financial decisions.

Does this apply to my company?

Imagine that your company exports products to the United States and settles transactions in USD. If the USD exchange rate weakens against the PLN, your revenues, converted to PLN, will be lower. On the other hand, if you import raw materials from Europe and pay in EUR, and the euro exchange rate increases, your costs will also increase.

An example from real life:

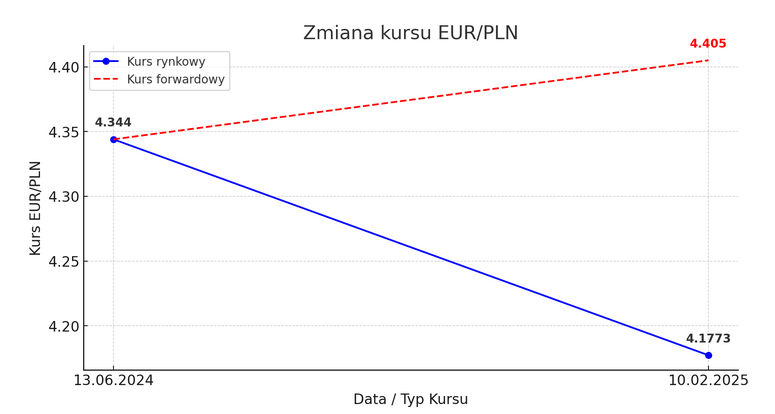

Let's assume you have a company that exports products to Germany and sells them in EUR. When you set the terms of the order with deferred payment, the average NBP exchange rate on 12-06-2024 was 4.3354 EURPLN. On this basis, you calculated your margin and profit. At the time of payment (10-02-2025 - 7 months later), PLN strengthened and the exchange rate fell to 4.1773. This means that for every euro you earn, you get 15.8 grosz less. With a contract worth 500,000 EUR, you lose almost 80,000 PLN!

Real security situation:

Let's assume that on the day of the above order execution, e.g. 13-06-2024, you would hedge the FX FORWARD contract by setting a transaction rate of 4.4050 EURPLN with the bank. When settling the payment from the client on 10-02-2025, the current rate is 4.1773 EURPLN. By hedging the transaction a few months earlier, you protect your margin and even earn more on the contract! Your profit taking into account the exchange rate difference is PLN 114,000. Do you still think it's better not to hedge and leave the position open?

Why is currency risk important?

- Impact on profits: Unfavorable changes in currency rates can reduce margins and therefore profits, or even result in losses.

- Liquidity problems: Exchange rate volatility makes cash flow planning difficult and can lead to problems with settling liabilities.

- Loss of competitiveness: A company that does not hedge its currency risk may lose its competitive advantage in the market.

Types of currency risk:

- Transaction risk: Related to short-term currency fluctuations that affect the value of specific transactions.

- Translation risk: This is the long-term change in currency exchange rates that affects the value of a company's assets and liabilities denominated in foreign currencies.

- Economic risk: Related to the impact of currency changes on a company's competitiveness in the international market.

How to manage currency risk?

There are many strategies and tools that help manage currency risk. The most popular ones are:

- Forward contracts: These allow you to set a currency exchange rate for a future date.

- Currency Options: Gives the right, but not the obligation, to exchange currency at a set rate. This is the most expensive strategy possible.

- Currency swaps: Involve the exchange of cash flows in different currencies.

The best strategies and tools are selected for the current business and market situation, and most often the most beneficial is a mix of them. There is no one golden solution. You have to answer the question whether you prefer to have a protected and assured margin, or do you prefer to take the risk when the rate rises/falls?

Summary:

Currency risk is a real threat to companies conducting international trade. Ignoring this risk can lead to serious financial consequences. However, effective currency risk management is not only protection against losses, but also an opportunity to increase competitiveness and improve the company's financial results. Thanks to appropriate strategies, companies can minimize the negative impact of currency fluctuations on their transactions, and also use favorable exchange rate changes to generate additional profits. It is worth remembering that currency risk management is a continuous process that requires regular analysis and adjustment of strategies to changing market conditions. The key here is to understand the specifics of the currency market, know the available financial instruments and be able to use them properly. That is why it is so important to understand what currency risk is and implement appropriate strategies to manage it, as well as constantly expand your knowledge in this area.

Comments (0)

Newest First